tax benefits of retiring in nevada

Most states use 100 of fair market value. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Retirees Can Earn This Much Without Paying Taxes

Ad Read this guide to learn ways to avoid running out of money in retirement.

. Simply just multiply the property tax rate by the your assessed value 032782 district tax rate. Nevada has far more sunny days and lower humidity to enjoy them than most states. 24 minutes agoUp to 50 of.

The state of Nevada does assess taxes on property. Youll Likely Pay Less in Taxes. The property taxes assessed on an.

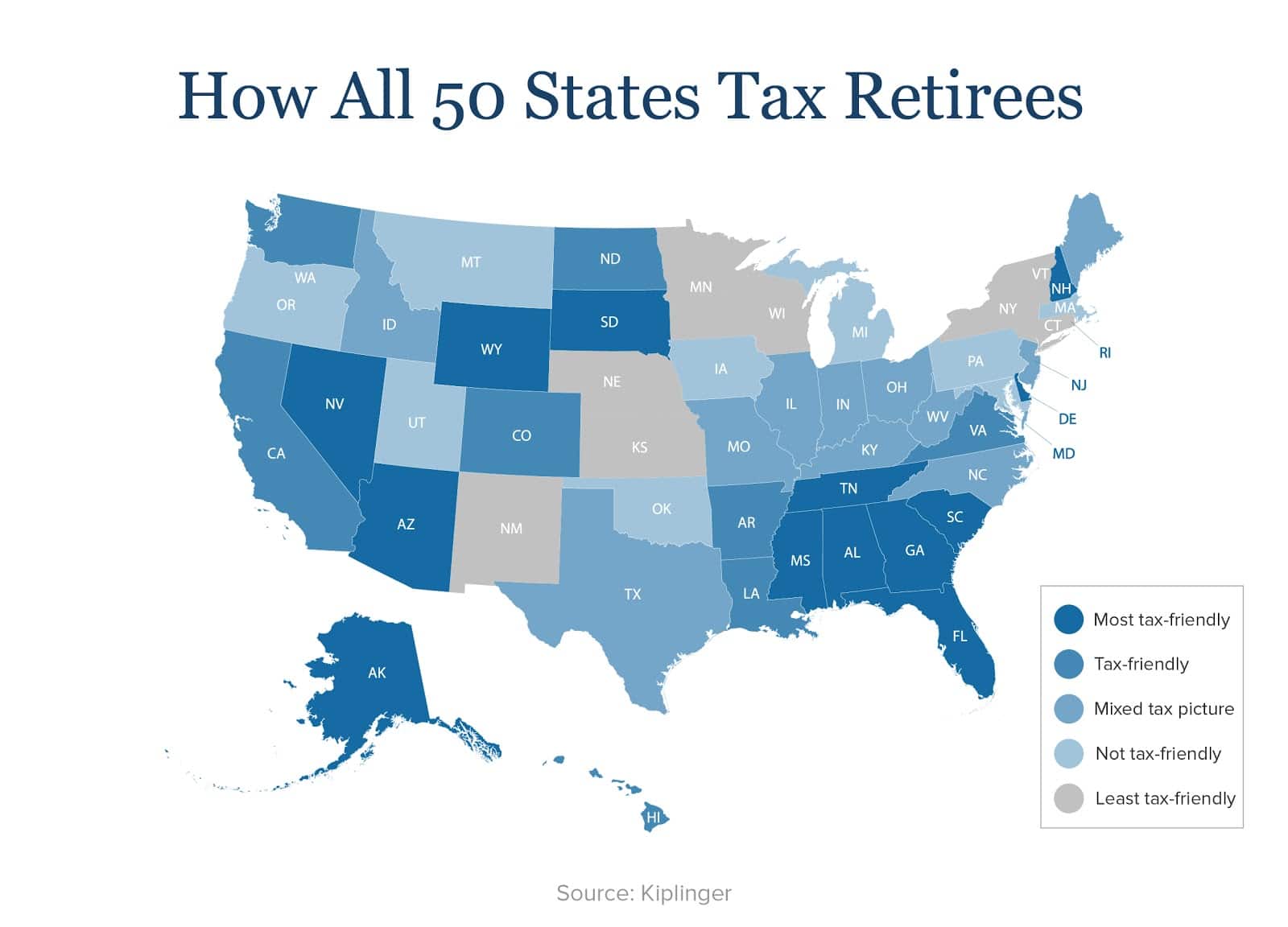

Tax benefits of retiring in nevada Saturday June 11 2022 Edit. State of Nevada employees voluntarily choose to participate in either of the two plans mentioned above. Nevada does not have an individual income tax.

Under the Employer Paid Contribution EPC plan the employer pays. A Kiplinger Special Report. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

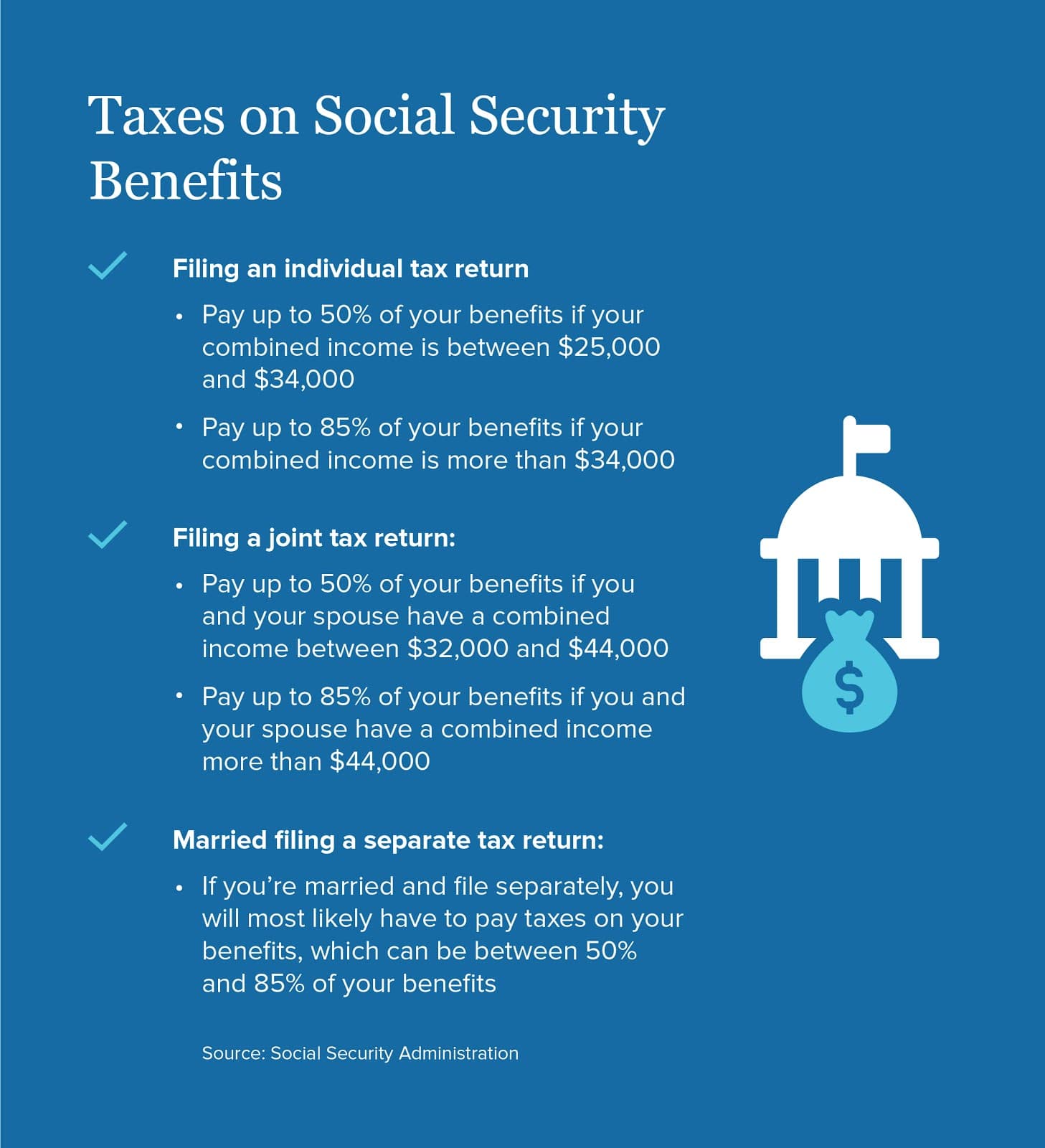

Up to 85 of benefits are taxable for. 5376 PDF file would require affected companies to pay taxes equal to at least 15 of adjusted financial statement income. Nevada does not have a corporate income tax but does levy a gross receipts tax.

1 How To Spend A Day In Scottsdale Az Arizona Road Trip Great Basin National Park Trip. Up to 50 of benefits are taxable for married couples filing a joint return who have a combined income between 32000 and 44000. See what makes us different.

Nevada has a 685 percent state sales tax rate a. They make middle class investing. Nevada also does not have a state income tax which is another benefit for senior citizens that reside in Las Vegas and are living on a budget.

In the top 10 of states according to data from NOAA. 1 day agoAnother corporate tax provision on page 2 of the HR. Your district is 200 and the in 2012- 2013 fiscal year the property tax rate was set at 32782.

10 hours agoIf you claim benefits early and have other retirement income sources you could find yourself paying more in taxes than you would have had you waited to collect your benefits. To avoid getting hung up unexpectedly plan for retirement using the TRICK. 15 hours agoWhen Congress slaps additional toll taxes on defined contribution retirement plans defined benefit plans mutual funds IRAs 529s etc.

The Most Tax Friendly. Ad File Your State And Federal Taxes With TurboTax. Nevadas property tax is based on a mere 35 of the fair market value of the property.

See If You Qualify To File State And Federal For Free With TurboTax Free Edition. However the amount of property taxes is not exceptionally high by most standards. We dont make judgments or prescribe specific policies.

See Why Were Americas 1 Tax Preparer. 11 hours agoHawaii topped the list of states that have the most diverse population in the country coming ahead of California and Nevada according to data from the US.

7 Countries That Offer Tax Breaks For Foreign Retirees

Helping Your Clients Execute A Tax Aware Investment Plan

How To Plan For Taxes In Retirement Goodlife Home Loans

Choosing A Retirement Destination Tax Considerations Lvbw

37 States That Don T Tax Social Security Benefits The Motley Fool

States That Don T Tax Retirement Income Personal Capital

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

37 States That Don T Tax Social Security Benefits The Motley Fool

10 Pros And Cons Of Living In Nevada Right Now Dividends Diversify

Nevada Tax Advantages And Benefits Retirebetternow Com

How To Plan For Taxes In Retirement Goodlife Home Loans

10 Tax Deductions For Seniors You Might Not Know About

How To Plan For Taxes In Retirement Goodlife Home Loans

Is My Pension Subject To Michigan Income Tax Center For Financial Planning Inc

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)